Did you know that economists use the local value of a McDonald's Big Mac as a guide for evaluating currency?

Did you know that economists use the local value of a McDonald's Big Mac as a guide for evaluating currency?The Economist magazine's website reveals the details behind this intriguing fact. The Big Mac Index (a part of "Burgernomics") is explained on the site as follows:

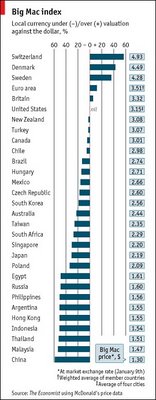

"Burgernomics is based on the theory of purchasing-power parity, the notion that a dollar should buy the same amount in all countries. Thus in the long run, the exchange rate between two countries should move towards the rate that equalises the prices of an identical basket of goods and services in each country. Our "basket" is a McDonald's Big Mac, which is produced in about 120 countries. The Big Mac PPP is the exchange rate that would mean hamburgers cost the same in America as abroad. Comparing actual exchange rates with PPPs indicates whether a currency is under- or overvalued. "

The McChronicles particularly enjoyed the video clip on the topic.

As this table indicates, you can buy a Big Mac in China for only US$1.30 but will have to pay nearly US$5.00 for it in Sweden. These values change daily as currency values fluctuate.

The McChronicles: A blog about, not affiliated with, McDonald's.

Image: The Economist Website

1 comment:

Your readers might be interested in the recent post the "Going Global" international business blog entitled "McMarket Research". It also includes a reference to the Big Mac index, as well as some other representations or uses of the Big Mac index concept. The main point of the post, however, is to raise the intriguing question whether McDonalds restaurants, given their inherent standardizaion and global reach can be used as a marklet research laboratory for companies looking into doing business in a given country.

The post can be found at www.exinglobal.typepad.com/going_global/2006/06/mcmarket_resear.html. Visit My Page.

Post a Comment